Rather than using the term substantial doubt, consider describing conditions (e.g., cash flows are not sufficient to meet obligations) and management plans to alleviate substantial doubt. Under IFRS Standards, management assesses all available information about the future, considering the possible outcomes of events and changes in conditions, and the realistically possible responses to such events and conditions. Events or conditions arising after the reporting date but before the financial statements are authorized for issuance should be considered.

Which of these is most important for your financial advisor to have?

Assessing the going concern problems in the company is the main Role and Responsibility of the management of the company. The following are the key procedures that management should do to assess the going concern problems. Then we should consider whether auditors put all possible procedures that should be performed or not. That means the quality of audit procedures is the place that should be questioned.

- Where risks, such as the ones mentioned above, have been identified, the auditor must respond to the risks by designing and performing appropriate audit procedures.

- Our publication provides some key disclosure and reporting reminders for upcoming filings and summarizes the SEC’s rulemaking and other activities that affect financial reporting.

- While some companies thrive from uncertainty, others may see their financial performance, liquidity and cash flow projections negatively impacted.

- (Supporting party name) will, and has the ability to, fully support the operating, investing, and financing activities of (entity name) through at least one year and a day beyond [insert date] (the date the financial statements are issued or available for issuance, when applicable).

Actions for management

Companies with low liquidity ratios, high employee turnover, or decreasing market share are more likely to not be a going concern. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos. We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources.

Do you own a business?

However, when the result of management assessment ongoing concern shows that the entity has no going concern problem, and auditors’ reviews also conclude the same thing while the actual is different. Auditors will use SAS 132, The Auditor’s Consideration of an Entity’s Ability to Continue as a Going Concern, to make going concern decisions. This SAS is effective for audits of financial statements for periods ending on or after December 15, 2017. SAS 132 amends SAS 126, The Auditor’s Consideration of an Entity’s Ability to Continue as a Going Concern.

If the support comes from an owner-manager, then the written evidence can be a support letter or a written representation. PwC refers to the US member firm or one of its subsidiaries or affiliates, and may sometimes refer to the PwC network. This content is for general information purposes only, and should not be used as a substitute for consultation with professional advisors. My Accounting Course is a world-class educational resource developed by experts to simplify accounting, finance, & investment analysis topics, so students and professionals can learn and propel their careers.

Going Concern Accounting and Auditing

The Eastern Company has closed a division but will continue working in its other divisions as usual. The business is a going concern because the closing down of a small portion of business does not impair the capacity of the enterprise to continue indefinitely in the future. Regardless of its weak financial standing, the National Company is still considered a going concern. The laws that bind corporations in all countries state that a company is presumed to have an uninterrupted existence with continuing activity until such time as it is legally liquidated.

The entire concept of depreciating and amortizing assets is based on the idea that businesses will continue to operate well into the future. Assets are also reported on the balance sheet at historical costs because of the going concern assumption. If we disregard the going concern and assume coronavirus stimulus check calculator 2020 the business could be closed within the next year, a liquidation approach to valuing assets would be more appropriate. Assets would be recorded at net realizable values and all assets would be considered current assets rather than being segregated into current and long-term categories.

Going concern is not officially included in the generally accepted accounting principles (GAAP) but some instruction is included in the generally accepted auditing standards (GAAS). The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links.

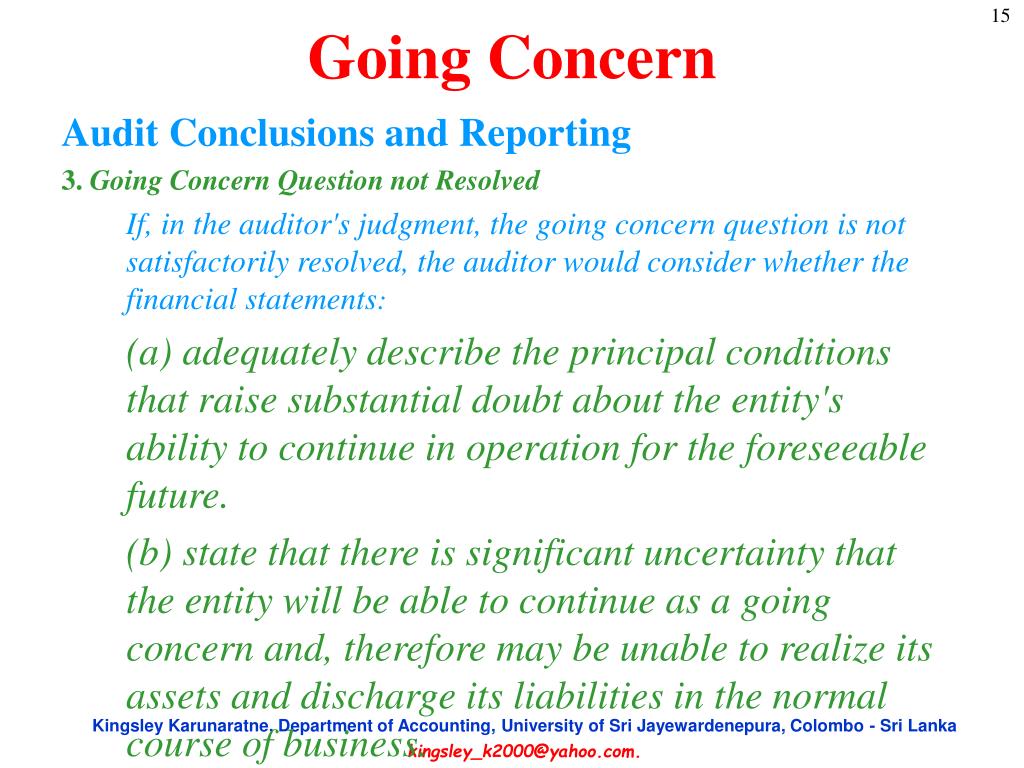

In order to assume that the entity has no going concern problem, the managements have to perform the proper assessment by including all relevant indicators that could cause the entity to close its business in the next twelve months period. In accounting, going concerned is the concept that the entity’s Financial Statements are prepared based on the assumption that the entity operation is still operating normally in the next foreseeable period. This foreseeable period normally has twelve months from the ending period of Financial Statements. The auditor should not use conditional language regarding the existence of substantial doubt about the entity’s ability to continue as a going concern. SAS 132 provides guidance concerning the auditor’s consideration of an entity’s ability to continue as a going concern.